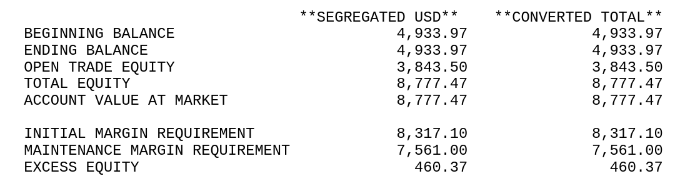

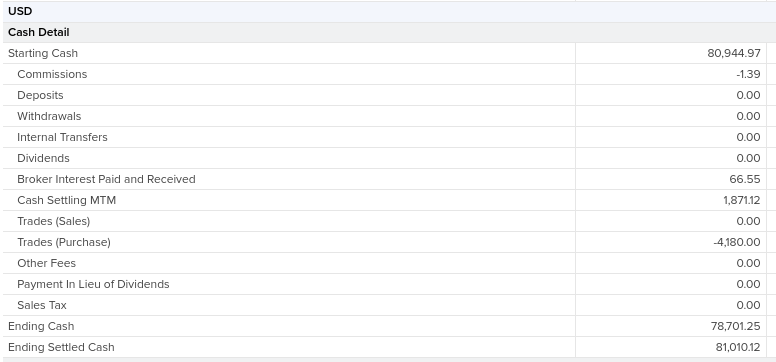

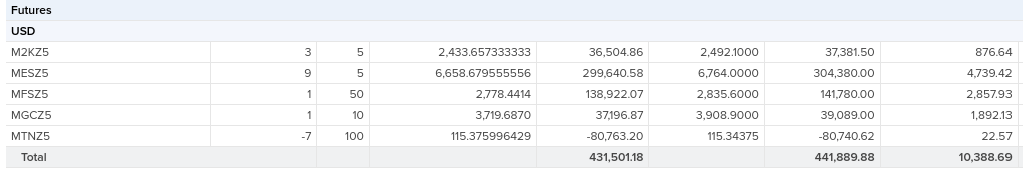

# Futures Cash Position It can sometimes be difficult to calculate the cash position in an account with futures due to the good faith deposit (margin) requirement and the current mark-to-market value of the futures. ## Schwab A typical daily futures statement will look like this:  The current positions page might look like this:  `OPEN TRADE EQUITY` is the futures value. To find the true cash position it would be: ```math \text{Total Cash & Cash Investments} + \text{Futures Cash} - \text{OPEN TRADE EQUITY} = 12602.91 + 8777.47 - 3843.50 = 17536.88 ``` ## Interactive Brokers The daily activity statement will have under `Cash Report`:  Under `Open Positions` the `Unrealized P/L` is the futures value:  To find the true cash positions it would be: ```math \text{Ending Cash Total} - \text{Futures Unrealized P/L} = 78701.25 - 10388.69 = 68312.56 ```